2023 Hong Kong Consumer Survey - FemTech

FemTech Association Asia explores Values, Affordability, Awareness and Accessibility

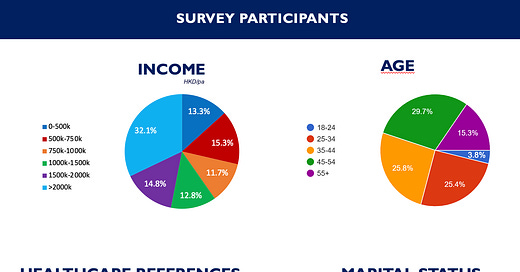

FemTech Association Asia completed a survey in December 2023 of 209 HKID holders in Hong Kong. Qualified participants for this online survey included women, and those with women’s healthcare needs, who are residents of Hong Kong and 18+ years old.

Results highlight perspectives about healthcare from consumers based in the Hong Kong market: Values, Affordability, Awareness and Accessibility of femtech solutions.

The results from this 2023 Consumer Survey provide insights for femtech businesses operating in Hong Kong and those looking to enter the market.

To learn more, please contact us or follow us on LinkedIn or Instagram. Special thanks to FemTechAssociation Asia members, in particular Kristen Carusos, and the community for their support!

VALUES

When it comes to how Hong Kong women manage their health, more than half of survey participants said they treat their health and wellbeing as a priority. Hindrances to a health-first lifestyle approach most often result from a lack of time (20%) and budget (19%). 22.5% of women stated they do not think about their health outside of wellness checks.

In March 2018, Frost & Sullivan stated that “90% of women are primary healthcare decision makers for their friends and key influencers for friends”. This aligns with the low 15% of survey participants who said their healthcare needs are last on their list to manage behind their families, work, etc. (For comparison, our 2022 Singapore Consumer Survey quoted 9%.)

As for the healthcare qualities women in Hong Kong value, ‘Cost’, ‘Trust/Familiarity’, and ‘Convenience” ranked as the top three (3) most frequently selected criteria. ‘Patient Care’ and 'Accessibility/Speed of Service' also ranked high as important qualities for healthcare.

While Hong Kong does have public healthcare for all residents, the private sector accounts for 75% of primary healthcare expenditure and handles 68% of outpatient doctor consultations according to Hong Kong Health Bureau.

Where convenience is a top priority for women in Hong Kong, longer wait times are a deterrent to using the public system. It can take up to 5-7 hours to see a doctor for an emergency and up to one week for outpatient urgent cases according to the Hong Kong Hospital Authority.

Semi-urgent cases can wait up to eight (8) weeks and non-urgent cases may wait up to 100 weeks for specialists or surgeries.

AFFORDABILITY

While cost is a primary consideration, 76% of surveyed women said that healthcare is affordable in Hong Kong, with the remaining 24% finding the expense significant for their personal budgets. 60% of women in Hong Kong spend over 5,000 HKD per year on their personal healthcare needs. 37% spend over 10,000 HKD per year.

AWARENESS

Participants were also asked which three categories of women’s health & wellness they know the most and least about:

45% of consumers surveyed also said they are familiar with the term “femtech”, with the vast majority referencing ’period trackers’ as the specific femtech product/service used.

The most mentioned femtech products were period tracking apps like Clue and Flo, or fitness apps with period tracking features such as FitBit, Garmin and Apple Health.

Pregnancy and Fertility tracking apps like Oura, Baby Center, and Ava were also noted, as well as mental health and telehealth apps, BetterHelp specifically.

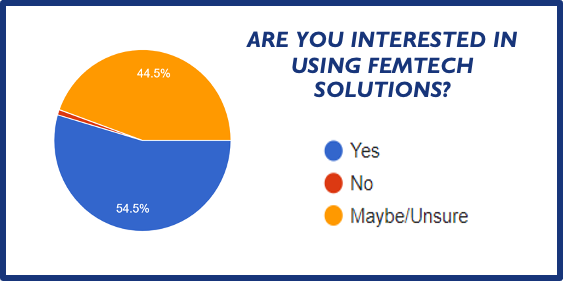

Nearly all (99%) women in Hong Kong are open to using femtech solutions.

•90% of 18-24 year olds already use FemTech products & services

•65% of 25-44 year olds engage with femtech in some way for their healthcare needs

ACCESSIBILITY

88% of respondents say healthcare in Hong Kong is accessible. Healthcare accessibility is not a challenge for the majority of women in Hong Kong, though for those that said healthcare is not easily accessible (12%), the reason was always related to cost of private healthcare, with references to limited budget, low salary, limited healthcare network, or being under/uninsured.

52% of Hong Kong women rely on their doctor as their primary source of healthcare information, with the internet cited as first-visited by 65%. Friends (40%) and Family (30%) were also ranked highly with only one participant listing “Femtech” as their first source for information regarding their health.

CONCLUSION

Though women’s health has historically been under-researched, underserved and underfunded, the femtechindustry in Asia is rapidly gaining momentum. In March 2022, Asia Nikkei reported that “Asia is home to just 14% of the world’s femtech companies but is set to make the most of the boom.” FemTech Analyticspredicts that “by 2026 the Asia-Pacific region will see the world’s fastest growth in women’s health apps.”

Women make up four (4) of Hong Kong's 7.4 million population and has one of the fastest aging populations in the world with 20% of the population over 65 years old. Women in Hong Kong also have six (6) additional years of average lifespan compared to men.

With Hong Kong's current demographics, there are many opportunities for founders, companies, investors and ecosystem partners to drive women’s health innovation, especially in underserved categories like menopause, chronic illness, and mental health.

FemTech Association Asia is the region’s first and largest industry advisory and network for founders, professionals and investors uniting with the core focus on improving women’s health through technology solutions. Please reach out to connect and learn more.